Business and Other Risks

Risk Management Structure

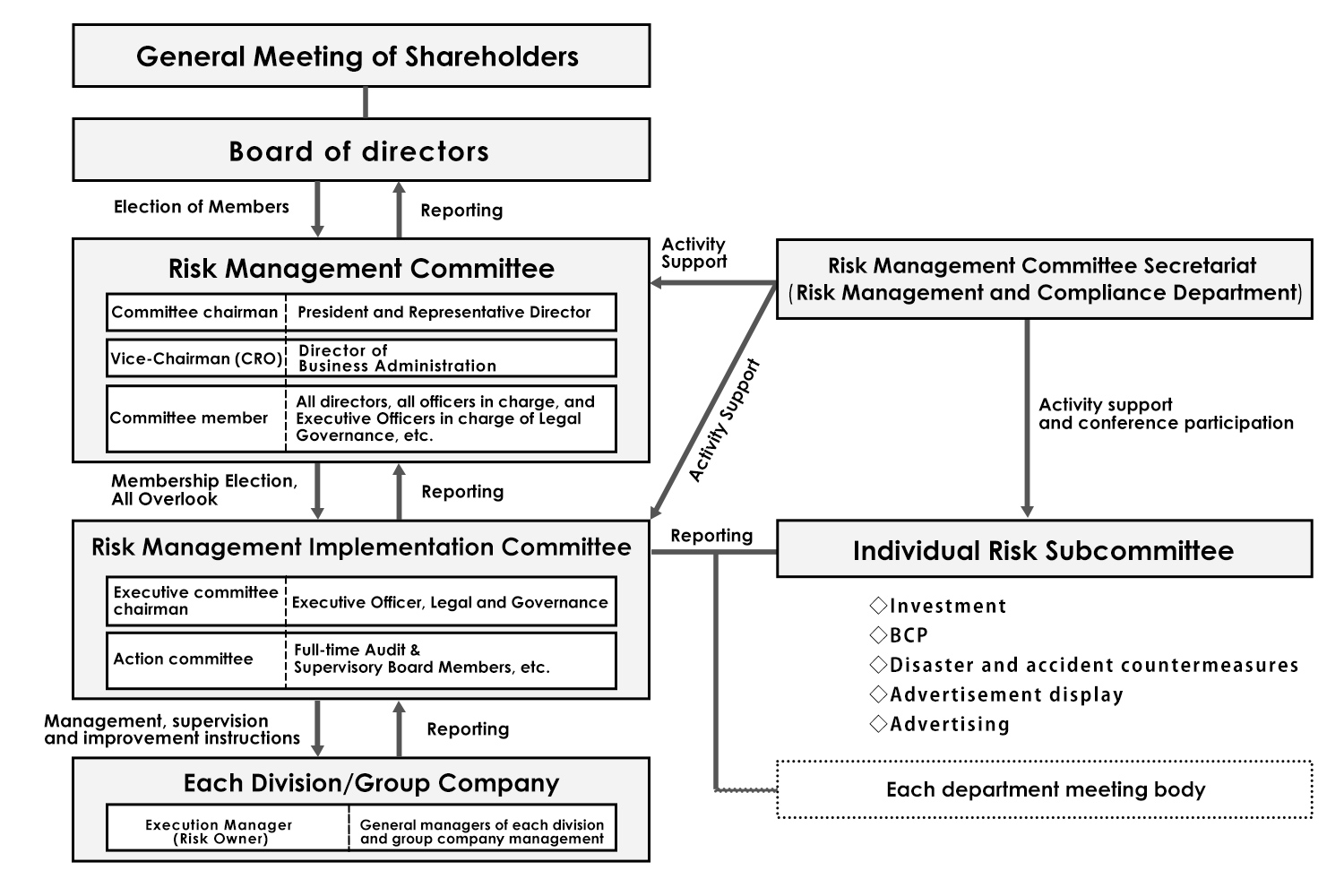

In accordance with the "Risk Management Regulations" and other relevant regulations, the Group has established a Risk Management Committee to oversee the risk management activities of the entire Group, and has established and is operating a risk management system.

Risk Management Process

Based on the business environment and social trends surrounding our group, we periodically review risk items each fiscal year, evaluate business and other risk items based on "impact" and "likelihood of occurrence," select important risks that should be addressed as a priority by our group at the Risk Management Committee, determine risk countermeasures (avoidance, transfer, reduction, etc.), and monitor the progress of the countermeasures. The Risk Management Committee then decides on the risk countermeasures (avoidance, transfer, reduction, etc.) and monitors the progress of the countermeasures.

Major Risks of the Group

The following are major risks that may have an adverse effect on the financial position and operating results of the Group among the matters related to business conditions, accounting conditions, etc., described in the Annual Securities Report, and are considered to be matters that may have a material effect on investors' decisions.

Forward-looking statements in this text are based on the judgment of the Group as of the end of the current fiscal year, but are not limited to the items listed here.

The following table indicates the relationship with the management policy for the medium- to long-term growth of our group, and the scope and extent of impact on the medium- to long-term growth of our group in the event that major risks become materialized. The degree and timing of the possibility that such risks may materialize are not indicated because it is difficult to reasonably foresee such risks.

Management Policy for Medium- and Long-term Growth

- 1. Management rooted in the Hikari Philosophy

- 2. Strengthen management system

- 3. Invest in brands that realize the business vision

- 4. Strengthen stock business

- 5. Strengthen R&D

- 6. Restructuring of overseas strategies

(1) Risks related to business activities

(1) Adaptation to consumer needs

(Management Policy:3. 4. 5.)

In order to meet consumer needs, the Group develops attractive new brands and products, cultivates new brands and products through marketing activities, and strengthens existing brands and products. The Group's ability to meet consumer needs has a significant impact on its sales and profits. In addition, the Group continues to withdraw existing brands and products that no longer meet consumer needs. However, because such activities are by their nature subject to uncertainty due to a variety of factors, failure to achieve the initially intended results could have a negative impact on the Group's financial position and operating results.

(2) Risk of dependence on specific brands and products

(Management Policy:3. 4. 5.)

The Group aims to continuously create new brands and products based on a brand development system that integrates the four pillars of "creation," "technology," "branding," and "marketing," and to develop its business without being biased toward any particular brand or product, The Company is actively developing a wide range of brands and products, centering on the ReFa and SIXPAD brands, in order to increase the number of brands and products and to reduce its dependence on specific brands and products. However, the ReFa and SIXPAD brands accounted for the majority of net sales (70.2% and 21.9% of net sales, respectively) in the current fiscal year, and business activities to increase the number of brands and products are by their nature subject to uncertainty due to various factors. Therefore, if the initially intended results are not achieved, the financial position and business performance of the Group may be adversely affected.

(3) Risks related to overseas sales

(Management Policy:1. 2. 4. 5. 6.)

Our group has been developing sales overseas, mainly in China and other Asian countries, and in the current consolidated fiscal year, sales from global operations accounted for 2.1% of our group's total sales. Although we are strengthening the internal control systems of our overseas subsidiaries and the information gathering system at the head office, unforeseen changes in local economic conditions, deterioration of political relations with Japan, or new occurrences of inadequacies in the internal control systems of overseas subsidiaries may adversely affect the financial position and operating results, etc. of our group. (2) Risks related to the Group's financial position and operating results

(4) Risks related to advertising

(Management Policy:4. 5.)

As part of its brand strategy, the Group utilizes athletes and celebrities to promote its products and maintain and enhance its brand image. The Group's operating results and sales in overseas markets are partly dependent on brand ambassadors, etc. on a global basis and in certain regions, and advertising expenses accounted for a large 29.4% of selling, general and administrative expenses in the current fiscal year. However, the Group's financial position and operating results could be adversely affected if the advertising does not have the intended effect, or if the reputation of the brand ambassadors, etc. declines or is expected to decline due to personal, legal, or other factors.

(5) Risks related to intensified competition

(Management Policy:4. 5.)

The Group's business performance may be affected by the trends of its competitors. In order to survive in a competitive environment, our group actively invests in the development of new brands and products. At the same time as developing new brands and products, we are also actively investing in securing intellectual property rights to prevent competitors from developing similar products and to establish solid brand value. However, unforeseen developments by competitors could have a negative impact on the Group's financial position and operating results.

(6) Risks related to information security

(Management Policy:1. 2.)

The Group takes various measures to protect information assets such as customer information and confidential information it holds. In addition, the Group has obtained "Privacy Mark (JIS standard)" certification, which certifies that a company is appropriately protecting personal information. However, in the event of an unforeseen leakage of information due to unauthorized access, the financial position and business performance of the Group may be adversely affected.

(7) Risk of quality problems such as occurrence of recalls

(Management Policy:1. 2. 4. 5.)

Based on a brand development system that integrates the four axes of "Creation," "Technology," "Branding," and "Marketing," the Group continuously creates new brands and products, always developing products with new functions and structures that did not exist before. The Group has introduced a review board system in which advisors also participate, and always emphasizes quality in the development of products in new areas. However, a large-scale recall of products due to unintended product defects or other causes could have a negative impact on the Group's financial position and operating results.

(8) Risk of problems with consumers and rumors

(Management Policy:1. 2. 4. 5.)

The Group may experience problems if consumers do not experience the expected efficacy effects, or if they suffer health problems. The Group is particularly concerned with obtaining evidence of efficacy and is focused on providing consumers with authentic products. However, if the effects of such problems were to occur or spread through media reports, Internet postings, etc., and the image of the Group's products were to be tarnished, the financial position and business performance of the Group may be adversely affected. In addition, even in cases not directly related to our group's products, our group's financial position and business performance may be adversely affected if the image of our group's products is tarnished due to troubles caused by counterfeit products from other companies or rumors, etc.

(9) Risks related to the occurrence of returned goods

(Management Policy:1. 2. 4. 5.)

The Group is affected by the business practices of domestic mass retailers and other retailers, and there is a possibility that products sold in the past may be returned. The Group clearly states return conditions in contracts and discusses actual acceptance of returns with suppliers on an individual basis to prevent unnecessary returns and minimize the risk of returns. However, the Group accepts returns of defective products and other unavoidable cases, and incurs additional costs for processing returns and delivering replacement products.

(10) Risks related to materials and product supply

(Management Policy:2. 4. 5.)

The Group receives parts and products from external partners, including those overseas. In order to ensure the quality of parts and products, we hold partner cooperation meetings on a regular basis to reduce the supply risk of parts and products. In addition, some of the parts and materials used for ReFa supplied by external partners are difficult to replace, and we are dependent on a single supplier for the supply of these parts and materials. Therefore, the Group's financial position and operating results may be adversely affected in the event of unforeseen quality problems, business recession, or geopolitical tensions at an external partner that make it difficult to supply the materials and products that were initially anticipated.

(11) Risks related to new store openings

(Management Policy:2.)

The Group opens stores operated by the Company in department stores, duty-free stores, shopping centers, and mass merchandisers. The Group adjusts the number of stores based on store exit criteria, taking into account the profitability of each store, while at the same time reducing risk. However, if the profitability of stores after opening does not turn out as planned, the Group's financial position and operating results may be adversely affected.

(12) Risks related to stagnant inventory

(Management Policy:2. 3. 4. 5.)

The Group monitors inventory holdings and adjusts production and order quantities on a monthly basis to minimize inventory risk by formulating additional sales measures for products that are expected to be held in stock. However, the loss of sales opportunities due to shortages or backlogged inventory caused by misjudging demand trends could have a negative impact on the Group's financial position and operating results.

(13) Risk of dependence on specific persons

(Management Policy:2.)

Since its inception, our founder, Tsuyoshi Matsushita, has served as President and Representative Director. In addition to striving to recruit excellent human resources, we have divided our organization into profitable divisions (PC = profit center) and adopted a management system that operates based on a divisional profitability system, and we are striving to develop human resources with a management mindset as PC leaders and to train their successors. In addition, we are striving to build an organized business management system that does not depend on the personalities of a single individual, and Mr. Matsushita plays an important role in the promotion of our group's overall business and in brand building. If for some reason it becomes difficult for Takeshi Matsushita, President and Representative Director, to continue his duties for the Group, the financial position and business performance of the Group may be adversely affected.

(14) Exchange risk

(Management Policy:2. 4.)

Based on the policy that the Company bears the foreign exchange risk in intergroup transactions, the Company consolidates the impact of foreign exchange fluctuations on foreign currency transactions and manages foreign exchange fluctuations at the Company. We will also consider the introduction of forward exchange contracts, etc., depending on the increase in the ratio of overseas sales in the future. However, rapid fluctuations in foreign exchange rates may adversely affect the financial position and business performance of our group.

(15) Risks related to raw material price fluctuations

(Management Policy:2.)

In order to avoid dependence on a single external partner, the Group is pursuing multi-partner purchasing. However, if the supply-demand situation in the market or the raw material prices of parts and materials purchased from specific partners rise sharply, we may not be able to secure parts and materials at reasonable prices, and facing such an unstable raw material supply situation may adversely affect the financial position and business performance of our group. In this case, the Group's financial position and operating results may be adversely affected.

(16) Risks related to Human resources

(Management Policy:2.)

The Group is working to secure and develop excellent human resources by strengthening the recruitment of human resources through a variety of media and introducing a group management system to realize management by all employees. However, if we are unable to secure and train the necessary human resources as planned, our competitiveness may decline and business expansion may be hindered, which may adversely affect the financial position and operating results of our group.

(17) Risks related to the impact of social conditions, etc.

(Management Policy:2. 6.)

Our group receives parts and products from external partners, including overseas partners, and many of our products and goods are manufactured in overseas partners. Therefore, unexpected changes in laws and regulations or geopolitical tensions in the countries where our overseas partners are located could have a negative impact on our group's financial position and operating results.

(2) Risks related to legal regulations and litigation

(1) Risks related to intellectual property rights

(Management Policy:1. 2.)

The Group has strengthened its Intellectual Property Department, which manages patents and other intellectual property rights, and ensures that new technologies developed by the Group are protected by the Group's rights. In the development and marketing of our products, we take all possible precautions to prevent infringement of third-party intellectual property rights, such as conducting preliminary investigations to avoid infringement of patents, design rights, and other intellectual property rights of third parties, and taking measures to avoid infringement if such infringement is foreseeable. However, patents are filed daily in countries around the world, and in the event of unintentional infringement of a third party's patent or design rights, the Group's financial position and operating results may be adversely affected if it is subject to substantial claims for damages in or out of court.

(2) Risks related to compliance

(Management Policy:1. 2.)

The Group handles a wide variety of products in Japan and overseas and is therefore subject to a wide range of related laws and regulations. Specifically, there are the Companies Act, Financial Instruments and Exchange Act, tax laws, various industry laws, anti-monopoly laws, intellectual property laws, subcontracting laws, Act against Unjustifiable Premiums and Misleading Representations, Basic Consumer Law, e-commerce related laws, specified commercial transaction laws, and other laws and regulations in the relevant countries related to overseas business. The Group recognizes that compliance with laws and regulations is an extremely important corporate responsibility and has established a Compliance Committee to promote various compliance activities and ensure thorough compliance with laws and regulations. However, even with these measures, we cannot avoid risks related to compliance, including personal misconduct, as well as the risk of damage to social credibility and brand value. In the event that such risks materialize, the Group's financial position and operating results may be adversely affected.

(3) Risks related to permits and approvals

(Management Policy:1. 2. 5.)

The Group operates businesses that require licenses and permits, including Type 2 Pharmaceutical Manufacturing and Sales Business (expiration date: September 30, 2026), Type 2 Medical Device Manufacturing and Sales Business (expiration date: September 30, 2026), Medical Device Manufacturing Business (expiration date: September 30, 2026), Cosmetics Manufacturing and Sales Business (expiration date: February 18, 2024), Pharmaceutical Wholesale Sales Business (expiration date: December 18, 2024), etc. The Company operates businesses that require licenses and approvals such as medical device manufacturing (expiration date: September 30, 2026), cosmetics manufacturing and sales (expiration date: February 18, 2024), medical device manufacturing (expiration date: December 18, 2024), etc. Therefore, the Company has developed businesses that require licenses and approvals. Therefore, we are taking necessary measures to comply with the standards set forth by the relevant regulations. However, the Group may incur costs for countermeasures in the event of expiration dates or further tightening of regulations in the future, and in the event that it becomes difficult to respond, there is a possibility of business restrictions, such as revocation of business permits. If these possibilities materialize, the Group's financial position and operating results may be adversely affected.

(4) Risks related to product liability compensation for health problems, etc.

(Management Policy:1. 2. 5.)

The Group has an inherent risk of product liability claims for the products it sells, especially if they cause health problems, etc. The Group may be held liable for product liability. The Group has established a quality system to ensure product quality in order to address this risk. However, in the event of a product defect that could lead to product liability compensation, the Group's financial position and operating results could be adversely affected.

(5) Material Litigation, etc.

(Management Policy:1. 2. 5.)

As of the end of the current consolidated fiscal year, no lawsuits or other actions that would have a significant impact on our group have been filed. However, if a significant lawsuit or other action were to arise in the future and a judgment were rendered against our group, our financial position and operating results could be adversely affected.

(3) Risks related to disasters, etc.

(1) Risks related to disasters

(Management Policy: 1. 2. 4. 5. 6.)

The Group receives parts and products from external partners located in Japan and overseas. In order to avoid dependence on a single external partner for the supply of parts and products, the Group purchases from multiple suppliers. However, if an earthquake or other natural disaster, fire, explosion, or other accident were to occur in the area where the external partner is located, affecting the supply of parts and products, the financial position and business performance of our group may be adversely affected. In the event of a natural disaster such as an earthquake or fire in the area where our group's offices are located, we will set up a company-wide emergency headquarters to gather information on the damage and impact on our business, and establish a system to continue and restore our business, but this could have a negative impact on our financial position and operating results. However, there is a possibility that the financial position and operating results of the Group may be adversely affected.

(2) Risks related to incidents and accidents

(Management Policy:1. 2. 4. 6.)

However, we face the risk of sudden political instability (war, civil strife, conflict, riot, terrorism, etc.), which may adversely affect our financial position and business performance. However, the Group faces the risk of sudden political instability (war, civil war, conflict, riots, terrorism, etc.), which may adversely affect its financial position and operating results.

(3) Risks related to pandemics

(Management Policy:1. 2. 4. 6.)

In response to a global outbreak of infectious diseases, the Group may be affected by measures taken by governments of various countries, which may affect domestic and international logistics related to the Group's business, the production systems of its business partners, and restrict sales activities at stores. In the event of an actual outbreak of an infectious disease, our group follows government and prefectural guidelines and takes thorough measures to prevent the spread of infection. However, if the situation were to become prolonged or the spread of infection were to continue, the Group's performance and financial position could be adversely affected by factors such as a decline in demand due to the global economic downturn or impediments to the execution of business or the continuation of transactions.

(4) Risks related to financial accounting

(1) Risks related to strategic investments

(Management Policy:2.)

When promoting strategic investments such as investments in strategic markets, mergers and acquisitions, and business expansion into new businesses, the Group conducts studies and makes rational decisions after gathering necessary and sufficient information for decision making. These activities are important measures for the Company's growth. However, if the initially intended results are not achieved due to various unforeseen changes in the environment or other factors, the Group's financial position and operating results may be adversely affected.

(2) Risks related to accounting and taxation systems

(Management Policy:2.)

Newly introduced or changed accounting standards or taxation systems applicable to our group may adversely affect our financial position and operating results. Deferred tax assets are calculated based on estimates and assumptions regarding future taxable income, etc. However, actual taxable income may differ from estimates and assumptions, and if it is determined that all or part of the deferred tax assets cannot be recovered in the future, the deferred tax assets will be reduced, which may adversely affect our group's performance and financial position. In addition, the Group may have to deal with tax authorities when filing tax returns. In addition, differences in views with tax authorities in tax reporting may result in a higher-than-expected tax burden for the Group.

(3) Risk of dilution of share value due to exercise of stock acquisition rights

The Group grants stock acquisition rights as an incentive to the Group's directors, employees, and outside partners. As of the end of the current fiscal year, the number of potential shares resulting from these stock acquisition rights was 570,960 shares, representing 1.4% of the total number of shares issued and outstanding. If these stock acquisition rights are exercised, the total number of outstanding shares may increase and the value per share may be diluted, and this dilution of share value may affect the share price formation.