Corporate Governance

Basic Stance on Corporate Governance

Based on our corporate philosophy "One Shines, We Shine, All Shines." we are working to ensure transparency and fairness in decision-making and to strengthen corporate governance as one of the most important issues in corporate management, to achieve sustainable growth and increase corporate value over the medium to long term.

Compliance with Corporate Governance Code

The Company has implemented all the basic principles of the Corporate Governance Code.

For details, please refer to the Corporate Governance Report.

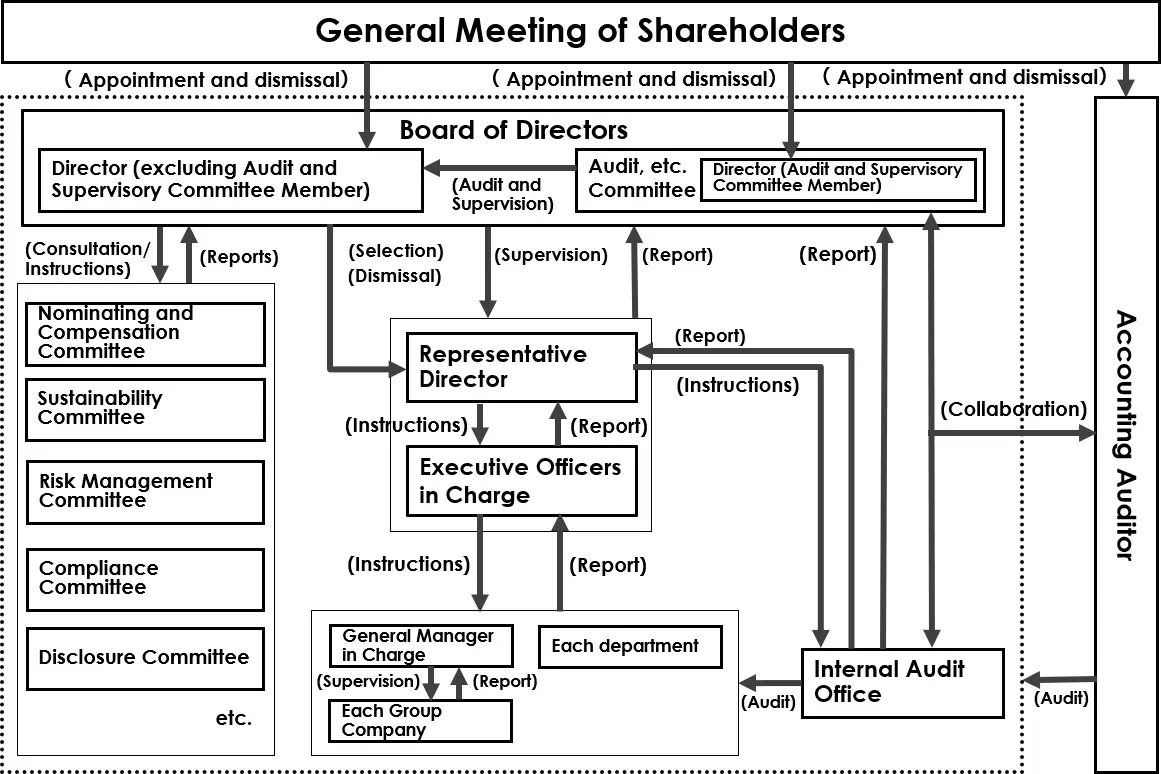

Corporate Governance Structure

Internal control system

(1) Basic Policy on Internal Control Systems and Status of Improvement

Basic Policy for Internal Control System

The Company has resolved the following “Basic Policy on the Internal Control System” at the Board of Directors meeting and is striving to further enhance the company-wide control environment and smoothly advance control activities.

To embody our corporate philosophy, the Group will establish a framework for lawful and efficient business execution by building an internal control system in accordance with the following basic policy. This system ensures appropriate organizational structure, establishment of regulations, information dissemination, and monitoring of business execution.

Furthermore, we continuously review this basic policy in response to changes in the business environment and strive to build and operate an effective internal control system at all times.

(1) Framework to Ensure the Execution of Duties by Directors and Employees Complies with Laws, Regulations, and the Articles of Incorporation, and Framework to Ensure the Proper Conduct of Business within the Corporate Group

The Group establishes various regulations, including the “Board of Directors Regulations,” and ensures thorough awareness among directors and employees.

To conduct business activities in compliance with laws, regulations, the Articles of Incorporation, internal rules, and general social norms, the Group establishes the “Compliance Charter” as a code of conduct. It strives to thoroughly instill compliance awareness and establishes and operates an effective system, including monitoring.

The Group establishes a Compliance Committee as the body overseeing the Group's compliance activities, in accordance with the “Compliance Regulations” and other rules.

The Compliance Committee shall inspect and refine various compliance regulations to build, maintain, and manage the Group-wide compliance framework. It shall promote awareness throughout the Group through training and other initiatives. Furthermore, it shall conduct regular inspections and review regulations in response to changes in laws and regulations or business activities, reporting these activities periodically to the Board of Directors.

The Group shall enhance its self-cleansing function against illegal acts, misconduct, etc., through the operation of an internal whistleblowing system.

The Group establishes a Central Audit Department within the Company. This department audits the entire Group from an independent standpoint while coordinating with the Company's Audit and Supervisory Committee and the accounting auditor. It reports audit status and findings to the Company's Representative Director and Board of Directors as needed or periodically.

The Group completely severs all ties with antisocial forces and responds resolutely to any unreasonable demands.

(2) Framework for Storing and Managing Information Related to the Execution of Duties by the Company's Directors, and Framework for Reporting Matters Related to the Execution of Duties by Directors and Employees of Group Companies

The Company records, stores, and manages various minutes and information related to the execution of duties by directors in documents, in accordance with the “Document Management Regulations” and other relevant rules.

The Company's directors, Audit and Supervisory Committee, and Central Audit Department may access these documents as necessary.

The Group, in accordance with the “Affiliated Company Management Regulations” and other rules, requires that important management decisions at group companies be reported to and resolved by the Company's Board of Directors.

(3) Regulations and Other Systems Concerning the Management of Risk of Loss for the Group The Group establishes a Risk Management Committee as the body overseeing the Group's risk management activities, in accordance with the “Risk Management Regulations” and other relevant regulations.

The Risk Management Committee systematically identifies and evaluates risks across the entire Group, devises countermeasures, and implements them. Furthermore, it conducts regular reviews and revises countermeasures in response to changes in circumstances, reporting these activities periodically to the Company's Board of Directors.

(4) Framework to Ensure Efficient Execution of Duties by Directors of the Group

The Company holds Board of Directors meetings once a month and convenes additional meetings as necessary. Important matters are deliberated in advance.

The Group operates in accordance with the “Division of Duties Regulations,” “Authority Regulations,” and other relevant rules, with department heads executing business operations within their respective areas of responsibility and authority.

(5) System for Employees Assisting the Audit and Supervisory Committee and Matters Concerning Their Independence from Directors, and Ensuring the Effectiveness of Instructions to Such Employees The Company shall establish an organization to assist the Audit and Supervisory Committee and assign employees to assist the Audit and Supervisory Committee in accordance with requests from the Audit and Supervisory Committee. The Audit and Supervisory Committee may issue instructions to such employees regarding matters necessary for audit operations. Furthermore, such employees who receive necessary orders for audit duties from the Audit and Supervisory Committee shall not receive any direction or orders from the Company's directors (excluding directors who are members of the Audit and Supervisory Committee) or other personnel regarding those orders. The Company's directors (excluding directors who are members of the Audit and Supervisory Committee) and the Human Resources Department shall ensure that all other employees are fully aware that such employees are to follow the direction and orders of the Audit and Supervisory Committee, and shall ensure that such employees have the necessary time to assist the Audit and Supervisory Committee in its duties.

To ensure the independence of such employees from directors other than Audit and Supervisory Committee members and the effectiveness of the Audit and Supervisory Committee's instructions, decisions regarding personnel matters concerning such employees—including appointment, transfer, and evaluation—related to the duties of the Audit and Supervisory Committee and its members shall require the consent of the Audit and Supervisory Committee.

(6) Framework for reporting to the Audit and Supervisory Committee by the Company's directors (excluding directors who are Audit and Supervisory Committee members) and employees, and framework for reporting to the Audit and Supervisory Committee by directors, auditors, persons involved in the execution of duties at group companies, or persons who have received reports from such individuals

The Company's directors (excluding directors who are Audit and Supervisory Committee members) and employees, as well as directors, auditors, persons involved in the execution of duties at group companies, or persons receiving reports from such persons, shall report on the status of their duties through the attendance of the Company's Audit and Supervisory Committee members at the Board of Directors meetings and other important meetings, and shall promptly report other necessary important matters.

The Company's directors (excluding directors who are Audit and Supervisory Committee members) and employees, as well as directors, auditors, persons involved in the execution of duties at Group companies, or persons receiving reports from such persons, shall promptly provide appropriate reports when requested by the Company's Audit and Supervisory Committee regarding matters related to the execution of business.

The Company's directors (excluding directors who are Audit and Supervisory Committee members), employees, and directors, auditors, persons involved in the execution of duties, or persons equivalent to these at group companies shall promptly report to the Company's Audit and Supervisory Committee upon becoming aware of any material violation of laws or regulations, violation of the Articles of Incorporation, improper conduct, or facts that may cause significant damage to the Company Group.

(7) Framework to Ensure Individuals Who Report to the Audit and Supervisory Committee Are Not Subjected to Disadvantageous Treatment Due to Such Reporting

The Company's directors (excluding directors who are members of the Audit and Supervisory Committee), employees, and directors, auditors, or persons involved in the execution of duties of group companies shall prohibit disadvantageous treatment of a reporter based on the fact that the reporter made a report to the Company's Audit and Supervisory Committee.

(8) Procedures for advance payment or reimbursement of expenses incurred in the performance of duties by Audit and Supervisory Committee members, policies regarding the handling of expenses or liabilities arising from such duties, and other systems to ensure the effective operation of the Company's Audit and Supervisory Committee

The Company shall bear the expenses incurred in the performance of duties by the Audit and Supervisory Committee. Such expenses shall be processed according to predetermined procedures.

To ensure the effective operation of the Company's Audit and Supervisory Committee, the Committee shall hold regular exchange meetings with the Company's Representative Director, the Audit Department, and the Accounting Auditor. Furthermore, the attendance of the Company's Audit and Supervisory Committee members at various meetings shall be ensured.

(2) Basic Approach and Status of Measures for Exclusion of Antisocial Forces

We resolutely refuse to have any dealings with antisocial forces that threaten social order and safety. We implement prior checks on new business partners, stipulate clauses excluding antisocial forces in contracts and other documents, and have established a system to collaborate with external specialized agencies such as the police and lawyers in preparation for receiving unreasonable demands from antisocial forces.

Board Member

Director

President and Representative Director

Tsuyoshi Matsushita

-

Apr.1989

Joined Nippondenso Corporation (currently Denso Corporation)

-

May.1992

Joined Yamahisa Corporation.

-

Jun.1994

Auto Service Blaze established.

-

Jan.1996

Established MTG Blaze Inc. (now MTG Blaze Inc.) Appointed Representative Director and President(to present)

-

Nov.2018

Establishment of Tsubaki of Gotō, Inc. as Representative Director

Significant Positions Held Concurrently

No significant concurrent positions

Director CFO

Akihiko Tajima

-

Mar.1988

Joined JEC Corporation Daiichi Education Center

-

Nov.1996

Appointed Director and General Manager of Accounting Dept.

-

Apr.1999

Appointed Director, General Manager of Accounting Division and General Manager of Finance Department of Gakuikusha Corporation (currently Withas Corporation)

-

Apr.2005

Director, General Manager of Business Administration Division, Withas Corporation

-

Oct.2005

Appointed Director of Ken Millennium K.K.

-

Mar.2006

Appointed as Director of Re-Tech Corporation

-

Dec.2009

Joined Kakuyasu Corporation, Executive Officer and General Manager of Finance & Accounting Dept.

-

Apr.2010

Appointed as Director of the above company

-

Apr.2011

Appointed Managing Director of the above company

-

June2016

Appointed Representative Director and Vice President of the Company

-

Oct.2020

Appointed Executive Vice President and Representative Director of Kakuyasu Group Inc.

-

June2022

Appointed President and Representative Director of the above company

Significant Positions Held Concurrently

No significant concurrent positions

Board Member

Yusuke Inoue

-

Mar.1987

Joined Grand Whisky Corporation (now Grandware Corporation)

-

Jun.1989

Established Presto Corporation, assumed post of Director

-

May1994

Established Plex Corporation (currently Phoenix Corporation) and assumed post of Representative Director

-

Aug.1998

Established Japan Trade Ocean Corporation (now SURGIC Corporation) and assumed the position of Representative Director

-

Aug.1998

Appointed Representative Director of Presto Co.

-

Apr.2011

Established andlive Inc. (currently MTG Professional Inc.) Appointed Representative Director(to present)

-

Jan.2014

Joined the Company, assumed post of Executive Officer

-

Dec.2015

Appointed Director of the Company (to present)

-

Sep.2020

Appointed Director, MTG FORMAVITA Corporation (to present)

-

Aug.2021

Appointed Representative Director of MTG Mediservices, Inc.

●In charge of Professional Services, Domestic Operations Management, Retail Store Operations, and Direct Marketing divisions

Significant Positions Held Concurrently

Representative Director, MTG Professional Corporation

Director, MTG FORMAVITA Corporation

Director (Outside)

Hironori Suzuki

-

Apr.1986

Joined (currently CIJ Next Co., Ltd.)

-

Jun.1991

Established SY System Co., Ltd. Appointed President and Representative Director

-

Jan.2004

Established Shanghai Yuritsu Software Co., Ltd. Appointed Corporate Representative and Chairman

-

Feb.2005

Appointed Representative Director of Chubu IT Cooperative

-

Mar.2006

Established Xi'an Yuri Software Co., Ltd. Appointed as Representative Director and Chairman

-

Aug.2011

Established SYS Vietnam Co., Ltd. Appointed as Representative Director

-

Apr.2012

Established PT. SYS INDONESIA Appointed as Komisaris (current position)

-

May.2012

Appointed Representative Director and Chairman of SK Corporation

-

Mar.2013

Appointed Representative Director and Chairman of SY System Corporation

-

Aug.2013

Established SYS Holdings Corporation; Appointed Representative Director and Chairman

-

Dec.2013

Appointed Director of Shanghai Yuritsu Software Co., Ltd.

-

Jan.2014

Appointed Director, Xi'an Yurih Software Co., Ltd.

-

Sep.2014

Appointed Representative Director, Chairman and President, SYS Holdings Co., Ltd. (current position)

-

Apr.2015

Appointed President and Representative Director of SY System Co., Ltd.

-

Oct.2018

Appointed President and Representative Director, Executive Officer of the same company

-

Oct.2022

Appointed Chairman of the Board of Directors of the same company (current position)

Significant Positions Held Concurrently

Chairman and President, SYS Holdings Co., Ltd.

Chairman of the Board of Directors, SY System Co., Ltd.

PT.SYS INDONESIA Komisaris (Auditor)

Director, Audit Committee Member

Norio Hasegawa

-

Apr.1986

Joined INAX Corporation (currently LIXIL Corporation)

-

Jan.2001

General Manager, Intellectual Property Office, Technology Management Dept.

-

Mar.2011

Senior Manager, Intellectual Property Management Office, Legal Department, LIXIL Corporation

-

Jan.2013

Joined the Company

-

Apr.2017

Executive Officer and General Manager of Intellectual Property and Legal Division Headquarters of the Company

-

Dec.2017

Appointed as Director of the Company

-

Jan.2022

Executive Officer, General Manager of Intellectual Property Division

-

Mar.2025

Appointed Director of the Company (Full-time Audit Committee Member) (to present)

Significant Positions Held Concurrently

There are no significant concurrent positions.

Director (Outside) Audit & Supervisory Committee Member

Munehiro Ishida

-

Dec.2007

Registered as an attorney (Tokyo Bar Association)

-

Dec.2007

Joined Miyakezaka Sogo Law Office

-

Jan.2017

Appointed Partner, Miyakezaka Sogo Law Office (current position)

-

Jun.2017

Appointed Auditor of Copa Corporation, Inc.

-

May2020

Appointed as Supervisory Director of B-Lot REIT, Inc.

-

Aug.2023

Appointed Auditor, Rehab for JAPAN Inc.

-

Dec.2023

Appointed Outside Director (Member of the Audit Committee) of the Company (to present)

-

Jan.2024

Appointed Auditor of ALC Corporation (to present)

-

May.2024

Appointed Auditor of Toen Co.

Significant Positions Held Concurrently

Partner, Miyakezaka Sogo Law Office

Corporate Auditor, Rehab for JAPAN, Inc.

External Corporate Auditor of ALC Corporation

External Corporate Auditor of Toen Co.

Director (Outside) Audit Committee Member

Ako Iida

-

Apr.2011

Joined KPMG AZUSA LLC

-

Aug.2014

Registered as a Certified Public Accountant

-

Jan.2022

Representative of Ako Iida Certified Public Accountant Office (present post)

-

Apr.2024

Appointed outside director of CASA Corporation (to present)

-

Mar.2025

Appointed Outside Director (Audit Committee Member) of the Company (to present)

Significant Positions Held Concurrently

Representative of Ako Iida Certified Public Accountant Office

External Director of CASA Corporation

Skill matrix for each director and each audit committee member

| Name | Position | Corporate Management, Corporate Strategy |

Development, Technology, IT |

Sales and Marketing | Internationalization & Diversity | Finance, Accounting, Capital Markets |

Legal, Risk Management |

|---|---|---|---|---|---|---|---|

| Tsuyoshi Matsushita | President and Representative Director | ○ | ○ | ○ | |||

| Akihiko Tajima | Director CFO | ○ | ○ | ○ | |||

| Yusuke Inoue | Director | ○ | ○ | ||||

| Hironori Suzuki | Director (Outside) | ○ | ○ | ○ | |||

| Norio Hasegawa | Director Audit Committee Member |

○ | ○ | ○ | |||

| Munehiro Ishida | Director (Outside) Audit Committee Member |

○ | ○ | ||||

| Ako Iida | Director (Outside) Audit Committee Member |

○ | ○ | ○ |

1. circle up to 3 main “skills expected to be demonstrated”.

2. "Governance" is not listed because it is required by all directors.

Executive compensation plan, etc.

Matters pertaining to the policy for determining the amount of remuneration, etc. for directors and corporate auditors or the method for calculating the amount of remuneration, etc.

The Company has established the following policy for determining executive compensation by the Board of Directors, after deliberation and report by the Nomination and Compensation Committee.

1. Basic Philosophy

Our company conducts business activities aimed at realizing our corporate philosophy: “One shines, all shine, everything shines.”

The “one” in “One shines” refers to each individual employee. We value every employee having dreams and walking a bright, positive, shining path toward a wonderful life. The ‘all’ in “All shine” refers to all employees, shareholders, customers, and partner companies. “Everything Shines” encompasses society as a whole. We aim not only to consider a sustainable global environment but also to contribute to the progress and development of human society, striving to make the lives of people worldwide healthy, beautiful, and abundant.

To realize this corporate philosophy, the purpose of the executive compensation system is to promote proactive challenges by executives and enhance corporate governance, thereby serving as a driving force for the sustainable growth of our business.

2. Policy on Determining Compensation Amounts, Including Base Compensation

The level of executive compensation is set based on the fundamental principles of executive compensation and the role and responsibilities of each director in the Company's management. When considering compensation levels, we analyze the Company's business environment and compensation market data (compensation levels of companies of similar scale to ours) provided by external research institutions. The appropriateness of the compensation levels is then verified by the Nomination and Compensation Committee before being set.

To foster shared awareness among all stakeholders and create a compensation system balanced toward both short-term and medium-to-long-term performance improvement, compensation for Directors (excluding Outside Directors and Directors serving as Audit Committee Members) consists of base compensation, performance-linked bonuses, and stock-based compensation.

For Outside Directors and Directors serving as Audit Committee Members, considering their role in supervising management and their independence, compensation consists solely of base compensation as a general rule.

Furthermore, directors are not provided with retirement benefits.

<Base Compensation>

Base compensation is set at an appropriate level commensurate with the director's position, scope of responsibility, and duties. It is subject to review as necessary in the event of changes to these factors or shifts in the external environment.

Base compensation is paid monthly in cash.

<Performance-Linked Bonus>

The performance-linked bonus is positioned as a short-term incentive. It is determined based on the achievement of the Group's consolidated annual sales and profit targets, as well as the performance of the directors. The amount ranges from 0% (no payment) to 200% of the midpoint of the variable compensation.

The performance-linked bonus is paid in a lump sum in cash.

*At the Nomination and Compensation Committee meeting held on November 20, 2025, the Company reviewed the performance-based bonus and decided to pay it as a lump-sum cash payment.

<Stock-Based Compensation>

Stock-based compensation is provided as a long-term incentive aimed at promoting the sustainable improvement of the Company's medium- to long-term performance and corporate value, and sharing value with shareholders from the same perspective. A certain percentage of the total compensation amount is paid in the form of restricted stock.

3. Compensation Determination Process

The Company's policy for determining executive compensation is deliberated by the Nomination and Compensation Committee, chaired by an outside director (independent officer) and comprising a majority of outside directors. The Committee submits its recommendations to the Board of Directors, which respects and resolves upon these recommendations.

Based on this compensation policy, the Nomination and Compensation Committee reviews the executive compensation structure annually. It verifies the appropriateness of the ratios and calculation methods for base compensation, performance-based bonuses, and stock-based compensation, taking into account market trends and other factors.

Similarly, the compensation for directors for each fiscal year is determined by the Board of Directors based on the specific compensation structure and metrics designed according to the compensation policy, following deliberation and recommendation by the Nomination and Compensation Committee. The Nomination and Compensation Committee is responsible for conducting the performance evaluations and qualitative assessments necessary for calculating directors' performance-based bonuses.

Limits on Remuneration for Directors and Corporate Auditors

The maximum amount of compensation for officers, as resolved by our shareholders' meeting, was set at an extraordinary shareholders' meeting held on March 24, 2017, at an annual amount not exceeding ¥500 million for directors (excluding audit committee members) and an annual amount not exceeding ¥100 million for directors (audit committee members). Furthermore, at the Ordinary General Meeting of Shareholders held on December 22, 2022, it was resolved that Directors (excluding Directors who are Audit Committee Members and Outside Directors) shall be granted restricted stock compensation (annual amount not exceeding ¥50 million, total number of shares granted annually not exceeding 50,000 shares) with transfer restrictions for a period determined by the Company's Board of Directors between 3 and 50 years.

Remuneration, etc. of Directors and Corporate Auditors

1. total amount of remuneration, etc. by director classification, total amount of remuneration, etc. by type of remuneration, etc., and number of directors subject to remuneration, etc.

| Executive Classification | Total amount of compensation, etc. (Millions of yen) | Total amount of compensation by type (Millions of yen) | Number of eligible officers (persons) | |||

|---|---|---|---|---|---|---|

| basic remuneration | performance-linked remuneration | lump-sum payment for retirement benefits | Non-monetary compensation, etc. | |||

| Directors (excluding audit committee members and outside directors) | 91 | 74 | 17 | - | 0 | 3 |

| Directors (Audit Committee Members) (excluding outside directors) | 9 | 8 | 0 | - | - | 1 |

| External Directors and External Corporate Auditors | 20 | 20 | - | - | - | 5 |

1. The total compensation amounts in the above table do not include ¥127 million equivalent to the compensation for the Senior Executive Officer.

2. The compensation amounts for Directors do not include the employee portion of salaries for Directors who also serve as employees.

3. The content of the performance indicators selected as the basis for calculating performance-linked compensation, the reasons for selecting those indicators, and the calculation method for performance-linked compensation are as described in “① Matters Concerning Policies for Determining the Amount of Directors' Compensation or Its Calculation Method: (b) Policy for Determining the Amount of Compensation Including Base Compensation.” Furthermore, the actual results for the performance indicators, namely the consolidated sales and profits of the Company Group for a single fiscal year, are as described in “Section 1 Overview of the Company 1 Trends in Major Management Indicators, etc.”

4. The non-monetary compensation consists of the Company's shares, and the conditions for allocation, etc., are as described in “① Matters Concerning Policies for Determining the Amount of Compensation for Directors or the Method for Calculating Such Amounts: (b) Policy for Determining the Amount of Compensation, Including Basic Compensation.” Furthermore, at the Ordinary General Meeting of Shareholders held on December 22, 2022, it was resolved to grant restricted stock compensation (annual amount not exceeding ¥50 million, total number of shares to be granted: 50,000 shares) with transfer restrictions for a period determined by the Company's Board of Directors between 3 and 50 years to directors (excluding directors who are members of the Audit and Supervisory Committee and outside directors). The number of directors (excluding directors who are members of the Audit and Supervisory Committee and outside directors) at the conclusion of the aforementioned shareholders' meeting was five.

5. The maximum remuneration amount for directors (excluding members of the Audit and Supervisory Committee) was resolved at the Extraordinary General Meeting of Shareholders held on March 24, 2017, to be within ¥500 million annually. The number of directors at the conclusion of the aforementioned shareholders' meeting was six.

6. The maximum annual compensation for directors (including Audit Committee members) was resolved at the Extraordinary General Meeting of Shareholders held on March 24, 2017, to be within ¥100 million. The number of directors serving as Audit Committee members at the conclusion of that General Meeting of Shareholders was three.

2.Total amount of consolidated remuneration, etc. for each director and corporate officer

Not stated because there are no people whose total amount of consolidated remuneration, etc. is 100 million yen or more.

3. Significant employee salaries of officers concurrently serving as employees

Not applicable.